L. Cong, K. Tang, J. Wang, Y. Zhang

Available at SSRN 3554486, 2020

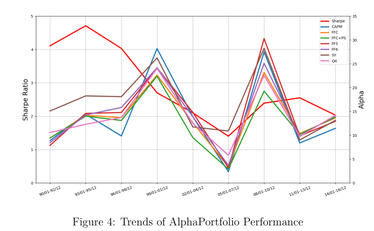

We propose reinforcement-learning-based portfolio management, an alternative to the traditional two-step portfolio-construction paradigm (e.g., Markowitz, 1952), to directly optimize investors’ objectives without estimating distributions of asset returns. Specifically, we modify cutting-edge AI tools such as Transformer to allow multi-asset sequence modeling that effectively captures the high-dimensional, non-linear, noisy, interacting, and dynamic nature of economic data. The resulting AlphaPortfolio yields stellar out-of-sample performances even after imposing various economic and trading restrictions. Importantly, we use polynomial-feature-sensitivity and textual-factor analyses to project the model onto linear regression and natural language spaces for greater transparency and interpretation. Such “economic distillations” reveal key market signals, firms’ financials, and disclosure topics, including their rotation and non-linearity, that drive investment performance. Overall, we highlight the utility of reinforcement deep learning and provide a general procedure for interpreting AI and big data models in social sciences.

@article{cong2020alphaportfolio,

title={AlphaPortfolio for Investment and Economically Interpretable AI},

author={Cong, Lin William and Tang, Ke and Wang, Jingyuan and Zhang, Yang},

journal={Available at SSRN},

year={2020}

}